Recently, I have been giving workshops on strategic planning in smaller organizations in the arts, culture, heritage and sport sector. One of the take-away tools I developed is this strategic plan template. Feel free to use it and be inspired in your thinking by it. I continue to offer custom workshops for your group, your network or organization on strategic planning, among other topics.

Category Archives: strategy

The next frontier: AI and the Arts

I was grateful to be invited by Business/Arts’ artsvest national program to develop and present a brand new 90-minute workshop on AI Tools for Smaller Arts Organizations. This workshop was first presented virtually to a national live audience of about 65 participants on October 8, 2025.

AI is no longer mere hype—it’s already reshaping how organizations across many sectors work including in the arts. Ready or not, AI is here and it is improving rapidly. In this session we will talk about what AI is good and bad at and how you can decide where to use AI tools in your organization.

This hands-on virtual workshop cuts through the noise and focuses on practical tools you can use right now to save time, stretch resources, and sharpen your communications. We’ll look at embedded AI tools in your office productivity software, operating system level AI, and we’ll take a deeper dive into Generative AI. You’ll learn how to decide whether to use AI for everyday tasks: drafting grants, marketing copy and materials; analyzing data; or streamlining admin tasks. We’ll explore affordable AI tools that fit into the systems you already use, from Canva, Mailchimp to presentations and spreadsheets, and highlight where automation could free up your team’s time.

We’ll also leave you with a simple governance checklist to keep your organization’s data, voice, and values safe. This session is designed for staff and board members who need clarity, not jargon, and want to see real-world results for their time and effort.

To book this workshop or a custom tailored working session for your group, get in touch with Inga Petri.

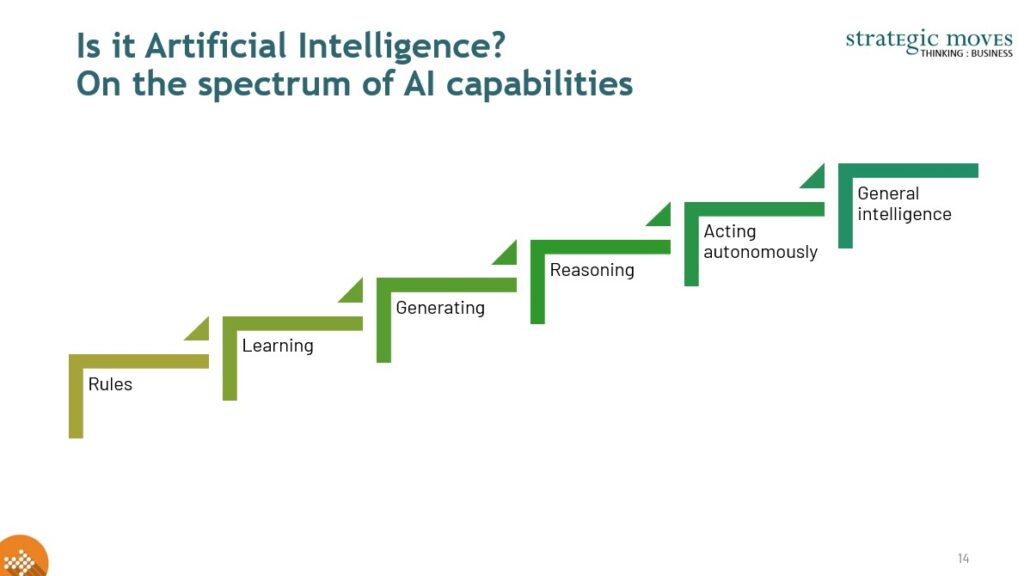

On the spectrum of AI capabilities

Artificial Intelligence (AI) is not a single monolithic technology but a spectrum of capabilities that range from basic automation to highly sophisticated generative and agentic systems. For small arts organizations, clarity about these distinctions is critical. It allows leaders to separate hype from reality and make grounded choices about how to incorporate AI into their workflows.

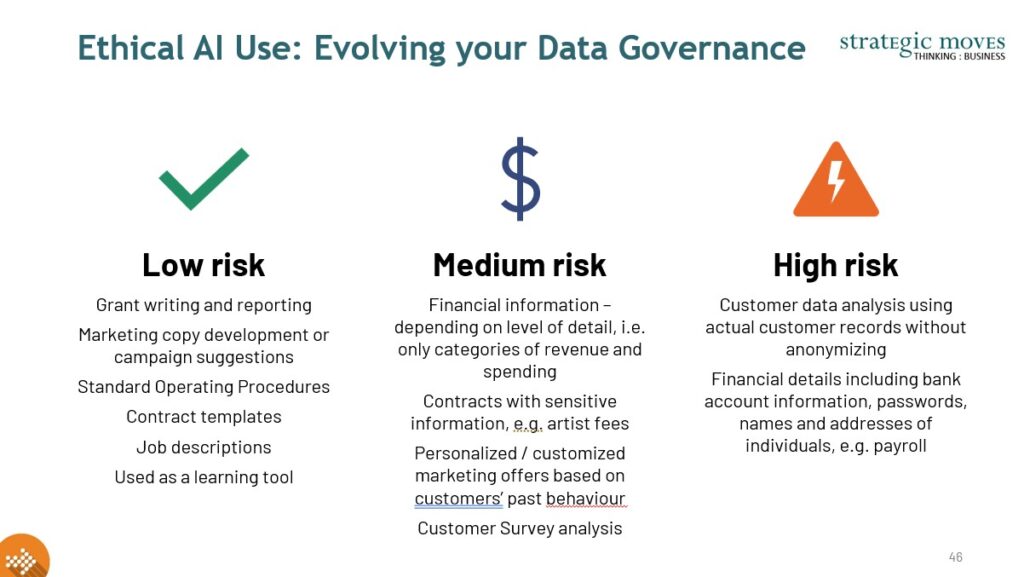

Ethical AI Use

While AI tools offer transformative potential, their adoption raises serious ethical and governance questions. For arts organizations that act as stewards of culture, creativity, and community trust, responsible use of AI is non-negotiable.

Privacy and Data Security

AI systems often require access to organizational or audience data. Whether training an AI on past grant reports or allowing cloud-based tools to process ticketing data, organizations must safeguard personal information. Under Canadian privacy law—including the **Personal Information Protection and Electronic Documents Act (PIPEDA)**—organizations are obligated to secure data, limit its use, and obtain meaningful consent.

2022 update on Demographic Change and the Performing Arts

This short video on demographic change is as fresh and needed today as it was a decade ago when I created it. The questions I posed for the performing arts have only become all the more urgent in this ongoing COVID pandemic reality – and in may ways they still beg to be fully answered by the live arts – as well as other sectors, like health care, housing, social services, technology.

Also, it should be obvious that the labour shortages we see now across almost every sector aren’t merely a COVID effect but largely a demographic effect. The COVID part seems more specific in that people who need to work are working but they aren’t as willing to earn low wages, and want reasonable working conditions. In fact, labour market participation is up in younger age groups as COVID recovery has advanced.

Changing Demographics and the Performing Arts from CAPACOA on Vimeo.

Here are a couple of articles on how the aging population is playing out when we don;t make the plans needed even though we can see the train leave the station decades in advance.

https://www150.statcan.gc.ca/n1/daily-quotidien/220427/dq220427a-eng.htm

https://www.cbc.ca/news/business/job-skills-shortage-1.6409237

https://www.cbc.ca/news/canada/ottawa/ottawa-workers-covid-retirements-1.6529325

11 Digital Workshops Available Online

PADE (Puppetry Arts Digital Evolution) project aimed to increase access to digital tools, resources and skills for puppeteers, multidisciplinary artists and arts organizations. Through this national initiative, we shared, learnt and planned how best to implement digital knowledge and tools into individual and joint digital discoverability, marketing, and strategic future plans.

All sessions were designed and facilitated by Inga Petri, Strategic Moves. These 11 workshops cover digital literacy and intelligence material that Inga developed for Making Tomorrow Better. These insights and more were shared with the Canadian arts presenting sector over 3 years from 2019 to 2021. This latest series is current as of March 2022.

- The Fundamentals Series

- Beyond the Fundamentals (From Search to Discoverability)

- Understanding Digital Business Opportunities and Revenue Models

Workshop Series 1 – Fundamentals

Workshop 1.1: Building an Effective Online Presence Assessment (60 min)

Workshop 1.2: Creating web content that connects with your audiences (75 min)

Workshop 1.3: Truly engaging: How to create social media posts that connect ( 75 min)

Workshop 1.4: Mastering Google (75 min)

Workshop Series 2 – Beyond Fundamentals: From Search to Discoverability

Workshop 2.1: Assessment SEO (75 min)

Workshop 2.2: Machine-Readable Content (90 min)

Workshop 2.3: Wikidata – Linked, Open Data/Wikidata (60 min)

Workshop 2.4: Discoverability Review (60 min)

Workshop Series 3 – Digital Business Opportunities and Revenue

Workshop 3.1: Digital Value Chain (90 min)

Workshop 3.2 – Hybrid Business Models

Workshop 3.3 – Digital Business Tools

Project Partners

Good Governance for Not-for-profit organizations in 2022

This primer has come about from a series of projects I have worked on in the last few years for clients in the arts, as well as board of directors outside the arts.

In early-stage societies, the board is often a working board, developing and providing services and programs directly to its membership, without any paid stuff and often relying on the deep involvement of the broader membership.

As organizations grow and mature and their scope increases, they tend to require increased capacity to deliver on their mandate. Capacity comes in two ways predominantly: money and people. As revenue streams are developed, and budgets increase, boards can hire their first paid staff person. The board begins to delegate some of their responsibilities to this person. As the staff complement grows, the board tends to move to being a management board that complements staff activities, and, eventually, to a “hands-off, nose-in” governance board concerned with strategy and policies that govern the organizations.

At each stage, the governing documents should be reviewed and updated to ensure they meet the needs to an evolving organization. As an employer, policies and procedures must be developed and updated to satisfy a wide range of legal obligations emanating from the Employment Law and Labour Standards, Tax legislation, Human Rights legislation, Occupational Health and Safety and any other relevant provincial and federal laws. Any delegation of day-to-day financial management should be explicitly defined to ensure the board’s fiduciary obligations and oversight are fully met. Evolving social obligations to serve a diverse membership and the community at large as well as practical considerations to provide standardized, reliable services and programs require a set of clear policies and procedures.

Up-to-date, transparent delineation of lines of authority, responsibility and accountability are crucial, in order to avoid legacy behaviours from an earlier stage of organizational development – such as maintaining the committee structure of a hands-on working board while having evolved to a governance board – and to avoid misunderstandings and misinterpretations that become detrimental to the health and vitality of the society.

This graphic shows the basic organizational dynamic: the delegation of powers (authority and responsibility) moving clockwise from the membership toward front-line staff, while accountabilities and reporting are moving in the opposite direction from staff back to the membership of the organization.

As staff delivers programs and services directly to members, their relationship with membership can and should be trusted and respectful. Notwithstanding that closeness, accountability from staff never goes directly to the membership or the board; staff members’ authorities and responsibilities are delegated through the executive director. Therefore, staff is accountable and reports to the executive director who in turn is accountable and reports to the board who in turn is accountable and reports to the membership.

Rebuilding Better – Nine Trends in the Performing Arts

9 years ago, in March 2013, I wrote a call to action for the performing arts presenting sector. It was an adjunct to the seminal Value of Presenting Study that I wrote to instigate sectoral action to secure the relevance of the sector in the mid- to long-term.

These Reflections and Recommendations were:

1. Strategy and organizational design to nurture capacity for change, strengthen relevance and resilience, come into the 21st century organizationally, in terms of marketing, programming and so forth

2. Building Meaningful Statistical Frameworks – Culture Satellite Account and Mapping the sector

3. Strengthen / Role in Communities – invest in competencies and professional development as a community leader, design for community impacts, ongoing awareness raising of value and benefits of the performing arts

4. Demography and Access – Know your community and your market; Access for seniors (technology-enabled), Partnering with Indigenous peoples, Partnering with recent Immigrants (EDI)

5. Digital Technologies – embrace online and mobile distribution of live arts, create a cross-functional working group to explore digital distribution in the live arts

6. Redefining Competition (focus on non-arts industries) – Define competitive value proposition (relative to non-arts competitors)

7. Experience Design – Brand-first relationship building (not merely transactional), secondary markets (digital impact)

Most of these feel as relevant as ever to me, showing how much more progress the live arts sector needs to make to join the contemporary world with all its complicated dynamics.

In light of COVID and the early stages of – and the vagaries of – COVID recovery in 2022, I have been talking about these 9 trends requiring urgent attention in the sector if it wants to rebuild better:

1.Mental health impacts

2.Financial precarity

3.Loss of expertise and talent – COVID

4.Digital transformation of society

5.Climate change and touring

6.Need new business models re: return to gatherings

7.Ways to support local artists

8.Digital Dissemination platforms

9.Justice, Equity, Diversity, Inclusion

In part it feels like the more things change the more they stay the same. It also feels like perhaps some of us have learned enough to really tackle the big issues.

https://lnkd.in/gJRdUyVx

Rebuilding Better – Vision for the Performing Arts 2022

I’ve been speaking at two in-person conferences recently (Contact East 2021 in Moncton and Pacific Contact 2022 in Coquitlam) on the hot button topic of Rebuilding Better. I have been proposing this Radical Intent (aka vision) for the Performing Arts as the sector tries to emerge from the worst of the COVID restrictions. The presentation has been called inspiring and has been generating much hallway conversation. So here it is.

1. Stop doing more with less. Breathe. Go for a walk in the woods, on the beach, in the mountains. Educate your funders to help them see how your effectiveness as an arts worker matters more than pushing out sheer volume.

2. Do less with more! Good pay, reasonable hours, improve mental health, improve working conditions. Take care of each other, be there: we are in this together.

3. Embrace digital connection. It is real and it is rapidly growing, if you like it or not is immaterial!

Go ahead and assess digital opportunities in your context, your community and your organization and build digital business lines if it makes sense.

Think about what it looks like to meaningfully disseminate or present live arts digitally. Learn about and adopt industry backbone application (The Pitch, I want to showcase, block booking, PPN, Side door)

4. Be the change you want to see. #MeToo, #blm, #truthandreconciliation

Act, don’t leave it at paying lip service; when its just words and intentions without action, folks see right through it – always.

5. Engage the public through the arts, not merely in the arts.

Climate change, housing availability, precarious employment, living wages/guaranteed income, fear-based politics / elections, dis- and mis-information, online bully pulpits – so many topics that could be made better for the majority of people as well as systemically marginalized people through creative and artistic interventions

6. Make a big difference in your community. What are the conversations that need to be had locally? Hot button issues? Get involved and convene people in conversations, curate shows to reflect on the issues, host solution summits.